JAKARTA, opinca.sch.id – Market Bubbles: Identifying, Understanding, and Navigating Speculative Excesses always seemed like that big, technical topic for analysts—until I got caught up in one myself. Let me spill my story (along with what I wish I’d known) so you don’t fall for the same traps.

Market bubbles are phenomena characterized by the rapid escalation of asset prices, driven by exuberant market behavior rather than intrinsic value. Understanding market bubbles is crucial for investors and market participants to navigate speculative excesses effectively. In this guide, I’ll share insights on identifying market bubbles, understanding their dynamics, and navigating them based on my experiences and lessons learned from past mistakes.

1. What Are Market Bubbles?

A market bubble occurs when the price of an asset significantly exceeds its fundamental value, often fueled by irrational investor behavior, speculation, and hype. Key characteristics of market bubbles include:

- Rapid Price Increases: Asset prices rise sharply over a short period, often outpacing any reasonable valuation metrics.

- Speculative Behavior: Investors buy assets not based on their intrinsic value but rather on the expectation that prices will continue to rise, leading to a herd mentality.

- Disconnection from Fundamentals: During a bubble, the underlying fundamentals of the asset (such as earnings, revenue, or economic indicators) become increasingly irrelevant to its market price.

2. Identifying Market Bubbles

Recognizing a market bubble can be challenging, but certain indicators can signal excessive speculation:

– Extreme Valuation Metrics

Look for assets with valuation metrics that deviate significantly from historical norms. Common indicators include:

- Price-to-Earnings (P/E) Ratios: Extremely high P/E ratios compared to historical averages can indicate overvaluation.

- Price-to-Book (P/B) Ratios: A P/B ratio significantly above 1 may suggest that investors are paying far more than the book value of the asset.

– Rapid Price Increases

Monitor assets that experience rapid price increases without corresponding improvements in fundamentals. A sudden surge in prices can indicate speculative behavior.

Example: During the dot-com bubble of the late 1990s, many internet companies saw their stock prices skyrocket despite lacking sustainable business models or profits.

– Increased Media Hype

Pay attention to media coverage and public sentiment. When assets receive excessive media attention and become a popular topic of conversation, it may indicate speculative excess.

Real Talk: I remember during the cryptocurrency boom in 2017, media coverage was everywhere, and everyone seemed to be discussing Bitcoin and altcoins. This hype contributed to inflated prices, which ultimately led to a significant crash.

3. Understanding the Dynamics of Market Bubbles

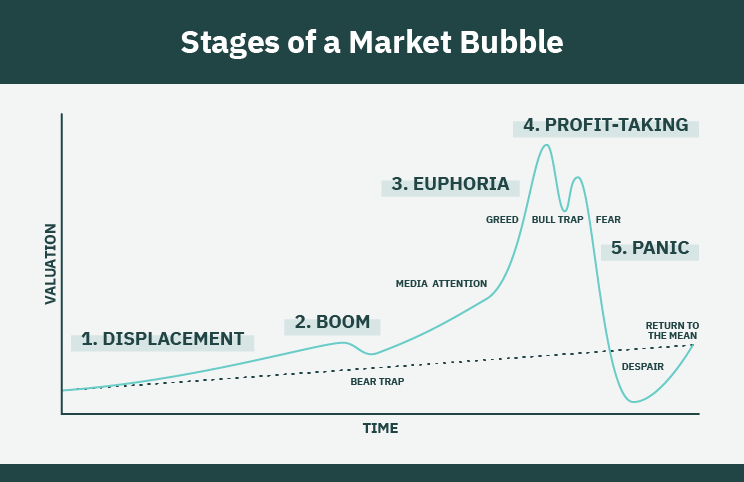

Market bubbles typically go through several stages:

– Displacement: A new innovation or trend captures investors’ attention, leading to increased demand for assets related to that trend.

– Boom: Prices start to rise rapidly as more investors enter the market, driven by excitement and the belief that prices will continue to increase.

– Euphoria: Investor sentiment reaches a peak, characterized by irrational exuberance. Many investors believe that prices can only go up, leading to speculative buying.

– Profit-Taking: Early investors begin to take profits, leading to a gradual decline in prices. This phase can trigger panic selling among latecomers.

– Panic: As prices fall, fear sets in, leading to widespread selling and a rapid collapse in asset prices.

4. Navigating Market Bubbles

Having learned from my experiences, here are some strategies to navigate market bubbles effectively:

– Conduct Thorough Research

Always perform thorough due diligence before investing. Understand the fundamentals of the asset and evaluate whether its price reflects its intrinsic value.

Tip: Use fundamental analysis to assess the financial health and growth potential of the asset you’re considering.

– Set Clear Investment Goals

Establish clear investment goals and risk tolerance. This clarity will help you make informed decisions and avoid getting swept up in the hype.

Example: During my early investing days, I failed to set clear goals and ended up investing in assets solely based on trends. This lack of direction led to significant losses when the market corrected.

– Diversify Your Portfolio

Diversification can help mitigate risks associated with market bubbles. By spreading your investments across different asset classes, sectors, and geographical regions, you can reduce exposure to any single asset.

– Be Prepared to Exit

Have an exit strategy in place. If you notice signs of a bubble or excessive speculation, be prepared to take profits or exit positions before a potential collapse.

Real Talk: I learned this lesson the hard way during the housing bubble. I held onto my investments longer than I should have, believing prices would continue to rise. When the market crashed, I faced significant losses.

5. Conclusion

Market bubbles represent speculative excesses that can lead to significant financial losses for investors. By understanding their characteristics, identifying warning signs, and navigating them strategically, you can protect your investments and make informed decisions.

Through my experiences, I’ve learned that staying grounded in fundamentals, conducting thorough research, and maintaining a disciplined approach are key to navigating market bubbles successfully. As we continue to witness the rise and fall of various asset classes, let’s remain vigilant and informed, ensuring that we approach investing with a clear understanding of the risks involved.

By recognizing the signs of market bubbles and implementing effective strategies, you can navigate speculative excesses like a pro and safeguard your financial future.

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Financial Innovation: Driving Change and Creating New Opportunities in Global Markets!”