JAKARTA, opinca.sch.id – Investing can feel like navigating a maze, especially when it comes to understanding investment returns. As someone who has walked this path, I can tell you that knowing how to calculate your profitability is crucial for making informed decisions. In this article, we’ll dive into the importance of understanding investment returns, share personal experiences, and offer practical tips to help you enhance your financial literacy. Let’s embark on this journey together!

Understanding Investment Returns

When we talk about investment returns, we’re essentially discussing the profit or loss generated by an investment relative to the amount of money invested. This concept is vital because it helps you assess whether your investments are working as hard as you are.

Why Are Investment Returns Important?

Understanding investment returns is essential for several reasons:

- Informed Decision-Making: Knowing your returns allows you to make better investment choices. You can compare different investment opportunities and select the ones that align with your financial goals.

- Financial Health Assessment: Regularly calculating your returns helps you gauge your financial health. Are your investments growing? Are you on track to meet your financial objectives?

- Risk Management: Understanding how your investments perform can help you identify risks and make adjustments to your portfolio accordingly.

Types of Investment Returns

Before we delve into calculations, let’s explore the different types of investment returns you may encounter:

1. Absolute Return

Absolute return measures the total return on an investment without considering any benchmark. It’s straightforward and reflects how much profit or loss you’ve made.

2. Relative Return

Relative return compares your investment’s performance to a benchmark, such as a stock index. This type of return helps you understand how well your investment is doing in the context of the broader market.

3. Annualized Return

Annualized return provides a yearly average return over a specific period, allowing you to compare investments of different lengths. It’s a useful metric for assessing long-term investments.

How to Calculate Your Investment Returns

Let’s get practical! Here’s a step-by-step guide on how to calculate your investment returns effectively.

Step 1: Determine Your Initial Investment

Start with the amount of money you initially invested. This figure is crucial as it serves as the baseline for all your calculations.

Step 2: Calculate Your Ending Value

Next, find out the current value of your investment. This includes any dividends, interest, or additional contributions you may have made.

Step 3: Use the Formula

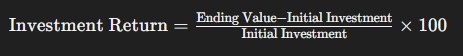

The basic formula for calculating investment returns is:

This formula gives you the percentage return on your investment.

Example Calculation

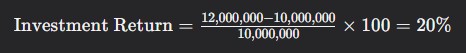

Let’s say you invested IDR 10,000,000 in a stock, and its current value is IDR 12,000,000. Here’s how you’d calculate your return:

- Initial Investment: IDR 10,000,000

- Ending Value: IDR 12,000,000

- Calculation:

Congratulations! You’ve earned a 20% return on your investment.

Common Pitfalls in Calculating Investment Returns

While calculating investment returns may seem straightforward, there are common pitfalls to watch out for:

1. Ignoring Fees and Taxes

Always account for transaction fees, management fees, and taxes when calculating your returns. These can significantly impact your overall profitability.

2. Focusing Solely on Short-Term Gains

While it’s tempting to chase short-term profits, remember that investing is a long-term game. Focus on the overall growth of your investments rather than just immediate returns.

3. Neglecting to Reassess Regularly

Your investment strategy should evolve with time. Regularly reassess your returns and adjust your portfolio to align with your changing financial goals.

Enhancing Your Financial Knowledge

Improving your financial knowledge is a continuous journey. Here are some actionable tips to help you along the way:

1. Educate Yourself

Read books, attend workshops, or take online courses on investing and financial literacy. The more you know, the better equipped you’ll be to make informed decisions.

2. Engage with Financial Communities

Join local investment clubs or online forums where you can share experiences and learn from others. Engaging with like-minded individuals can provide valuable insights.

3. Stay Updated on Market Trends

Follow financial news and market trends to understand how external factors can affect your investments. Knowledge of current events can help you make timely decisions.

The Role of Emotional Intelligence in Investing

Investing isn’t just about numbers; it’s also about emotions. Your mindset can significantly influence your investment decisions. Here’s how to cultivate emotional intelligence in your investing journey:

1. Practice Patience

Investing requires patience. Markets fluctuate, and it’s essential to remain calm during downturns. Avoid making impulsive decisions based on fear or greed.

2. Set Clear Goals

Define your financial goals and stick to them. Having a clear vision will help you stay focused and avoid getting sidetracked by short-term market movements.

3. Learn from Mistakes

Everyone makes mistakes in investing. Instead of dwelling on them, learn from your experiences and use them to improve your future decisions.

Conclusion

Understanding investment returns is a vital skill that every investor should master. By calculating your profitability effectively, you empower yourself to make informed decisions, manage your finances, and ultimately achieve your financial goals. Remember, financial literacy is a journey, not a destination. Embrace the learning process, stay curious, and continue to enhance your knowledge.

As you navigate the world of investing, keep in mind that your financial future is in your hands. With the right tools and knowledge, you can make your money work for you. Happy investing!

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Financial Security!”