JAKARTA, opinca.sch.id – Financial statements are essential tools for assessing the health and performance of a business. They provide a comprehensive view of a company’s financial position, enabling stakeholders—such as investors, creditors, and management—to make informed decisions. In this article, we will explore the different types of financial statements, their components, and how to analyze them to gain insights into your business’s health.

What Are Financial Statements?

Financial statements are formal records of the financial activities and position of a business, organization, or individual. They are typically prepared on a regular basis, such as quarterly or annually, and follow standardized accounting principles to ensure consistency and comparability. The three primary financial statements are:

- Income Statement

- Balance Sheet

- Cash Flow Statement

1. Income Statement

The income statement, commonly referred to as the profit and loss statement (P&L), summarizes a company’s revenues and expenses over a designated period, ultimately indicating the net income or loss. It provides insights into the company’s operational efficiency and profitability.

Key Components:

- Revenue: The overall revenue produced from the sale of goods or services.

- C O G S: The direct expenses associated with the production of goods sold.

- Gross Profit: Revenue minus COGS, indicating how efficiently a company produces its goods.

- Operating Expenses: Costs incurred during normal business operations, including selling, general, and administrative expenses (SG&A).

- Net Income: The profit or loss after all expenses, taxes, and costs have been deducted from revenue.

Example:

| Income Statement | Amount |

|---|---|

| Revenue | $500,000 |

| COGS | $300,000 |

| Gross Profit | $200,000 |

| Operating Expenses | $100,000 |

| Net Income | $100,000 |

2. Balance Sheet

The balance sheet offers a snapshot of a company’s financial status at a particular moment in time. It outlines what the company owns (assets), what it owes (liabilities), and the residual interest of the owners (equity).

Key Components:

- Assets: Resources owned by the company, categorized into current (cash, inventory) and non-current (property, equipment).

- Liabilities: Obligations owed to outside parties, also categorized into current (accounts payable) and long-term (loans, bonds).

- Equity: The residual interest in the assets of the company after deducting liabilities, representing the owners’ claim.

Accounting Equation:

The balance sheet is based on the fundamental accounting equation:

Assets=Liabilities+Equity

Example:

| Balance Sheet | Amount |

|---|---|

| Assets | |

| Current Assets | $200,000 |

| Non-Current Assets | $300,000 |

| Total Assets | $500,000 |

| Liabilities | |

| Current Liabilities | $100,000 |

| Long-Term Liabilities | $300,000 |

| Total Liabilities | $400,000 |

| Equity | $100,000 |

3. Cash Flow Statement

The cash flow statement provides information about the cash inflows and outflows of a company over a specific period. It highlights how cash is generated and used in operating, investing, and financing activities.

Key Components:

- Operating Activitiy: Cash flows generated from the primary business operations, encompassing receipts from sales and payments made to suppliers and employees.

- Investing Activities: Cash flows related to the acquisition and disposal of long-term assets, such as property, equipment, and investments.

- Financing Activities: Cash flows from transactions with the company’s owners and creditors, including issuing stocks, borrowing, and repaying debts.

Example:

| Cash Flow Statement | Amount |

|---|---|

| Cash Flows from Operating Activities | $150,000 |

| Cash Flows from Investing Activities | -$50,000 |

| Cash Flows from Financing Activities | -$30,000 |

| Net Cash Flow | $70,000 |

Analyzing Financial Statements

Understanding financial statements is crucial for assessing a business’s health. Here are some key metrics and ratios to consider when analyzing these statements:

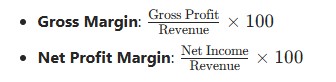

1. Profitability Ratios

These ratios help determine how effectively a company generates profit relative to its sales.

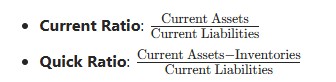

2. Liquidity Ratios

Liquidity ratios assess a company’s ability to meet short-term obligations.

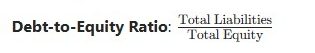

3. Leverage Ratios

This ratio measures the proportion of debt financing relative to equity, indicating financial risk.

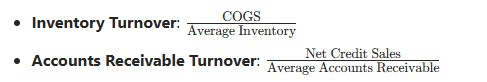

4. Efficiency Ratios

Efficiency ratios evaluate how well a company utilizes its assets.

Real-Life Application of Financial Statements

Understanding financial statements is not just for accountants or financial analysts; it’s essential for business owners and investors as well. Here are some real-life applications:

1. Decision Making

Business owners can use financial statements to make informed decisions about budgeting, pricing, and operational efficiency. For example, if the income statement reveals declining gross margins, management may need to investigate cost structures or pricing strategies.

2. Attracting Investors

Startups and growing businesses often rely on financial statements to attract investors. A well-prepared set of financial statements can demonstrate a company’s growth potential and operational efficiency, making it more appealing to potential investors.

3. Securing Financing

When seeking loans or credit, lenders will closely examine financial statements to assess the borrower’s creditworthiness. A strong balance sheet and positive cash flow statement can increase the likelihood of securing financing.

4. Performance Benchmarking

Companies can compare their financial statements against industry benchmarks or competitors to identify areas for improvement. This analysis can reveal competitive advantages or weaknesses that need addressing.

Conclusion

Financial statements are indispensable tools for understanding your business’s health from the inside out. By mastering the income statement, balance sheet, and cash flow statement, business owners and investors can gain valuable insights into profitability, liquidity, and overall financial stability.

Regularly analyzing these statements using key ratios and metrics allows stakeholders to make informed decisions that drive growth and success. Whether you are a business owner looking to improve operational efficiency or an investor seeking to evaluate potential investments, a solid understanding of financial statements is essential for navigating the complex world of finance.

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Earnings Growth Models!”