JAKARTA, opinca.sch.id –Investing wisely requires a deep understanding of the value of future cash flows generated by an investment. One of the most effective methods for valuing investments is the Discounted Cash Flow (DCF) analysis. This approach helps investors determine the present value of expected future cash flows, providing a clearer picture of an investment’s worth. In this article, we will delve into the DCF methodology, its significance, and how to apply it effectively to make informed investment decisions.

What is Discounted Cash Flow (DCF)?

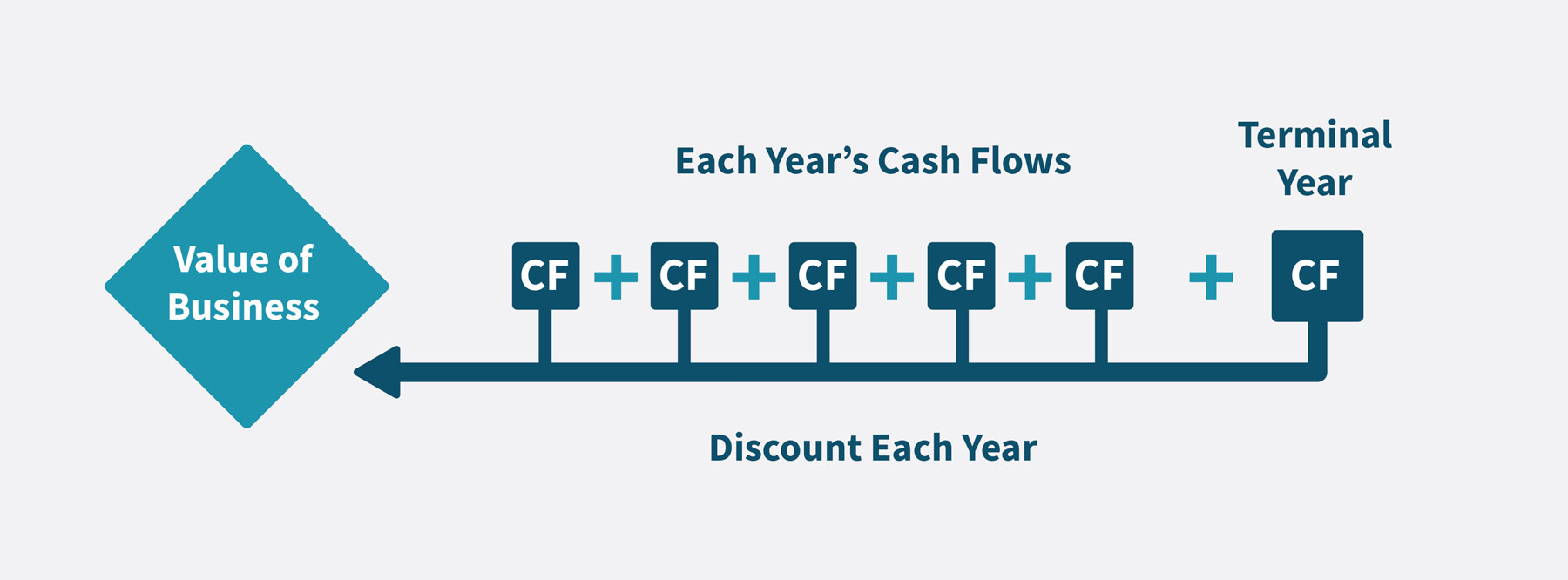

DCF method is is a financial valuation method employed to assess the appeal of an investment opportunity. It entails estimating the future cash flows produced by an investment and discounting them to their present value using a designated discount rate. This process takes into consideration the time value of money, acknowledging that a dollar today holds more value than a dollar in the future because of its potential to earn.

Key Components of DCF Analysis

- Future Cash Flows: These are the expected cash inflows and outflows from the investment over a specific period. Cash flows can come from various sources, such as operating income, dividends, or sale proceeds.

- Discount Rate: The discount rate reflects the risk associated with the investment and the opportunity cost of capital. It is often based on the required rate of return for similar investments or the weighted average cost of capital (WACC).

- Terminal Value: Since many investments generate cash flows beyond the explicit forecast period, the terminal value estimates the value of cash flows beyond this period. It is typically calculated using either the perpetuity growth model or the exit multiple method.

- Present Value: The present value is the sum of the discounted future cash flows and the terminal value, representing the total value of the investment today.

Why Use DCF Analysis?

1. Comprehensive Valuation

The DCF method provides a detailed and comprehensive view of an investment’s potential value. Unlike other valuation methods, such as comparable company analysis or precedent transactions, DCF focuses on the intrinsic value based on cash generation.

2. Flexibility

DCF analysis can be applied to various types of investments, including stocks, real estate, and projects. This flexibility makes it a versatile tool for investors across different sectors.

3. Focus on Cash Flow

By focusing on cash flows instead of accounting profits, DCF offers a more transparent view of an investment’s financial well-being. Cash flow is a critical indicator of an entity’s ability to generate returns for investors.

4. Consideration of Time Value of Money

The DCF method incorporates the time value of money, allowing investors to understand how future cash flows translate into present value. This is essential for making informed investment decisions.

Steps to Conduct a DCF Analysis

Step 1: Project Future Cash Flows

The first step in a DCF analysis is to estimate the future cash flows generated by the investment. This typically involves creating a financial model that projects cash flows over a specific forecast period, often five to ten years.

- Revenue Projections: Start with revenue estimates based on historical performance, market trends, and growth assumptions.

- Operating Expenses: Deduct operating expenses to arrive at operating income (EBIT).

- Taxes: Subtract taxes to calculate net income.

- Depreciation and Amortization: Add back non-cash expenses like depreciation and amortization to net income.

- Capital Expenditures (CapEx): Subtract capital expenditures needed to maintain or grow the business.

- Changes in Working Capital: Adjust for changes in working capital, which can affect cash flow.

Step 2: Determine the Discount Rate

Choosing the appropriate discount rate is crucial for accurately valuing an investment. The discount rate reflects the risk associated with the investment and the expected return required by investors.

- Weighted Average Cost of Capital (WACC): This is the most common discount rate used in DCF analysis. It considers the cost of equity and the cost of debt, adjusted according to their respective shares in the capital structure.

- Risk Premium: Adjust the discount rate for specific risks associated with the investment, such as market volatility, industry risks, or company-specific factors.

Step 3: Determine the Present Value of Future Cash Flows

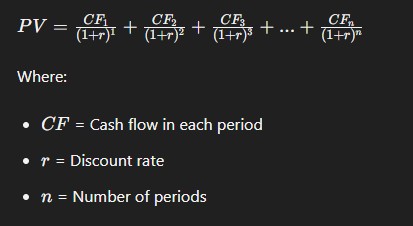

After projecting future cash flows and establishing the discount rate, the subsequent step is to compute the present value of those cash flows. The formula for calculating the present value (PV) of future cash flows is:

Step 4: Calculate the Terminal Value

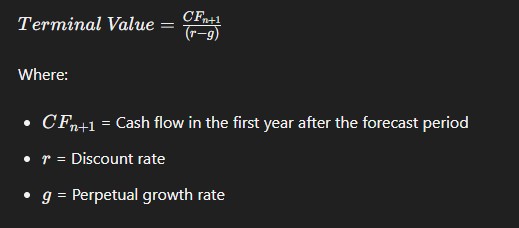

Since cash flows typically extend beyond the explicit forecast period, calculating the terminal value is essential. There are two common methods for estimating terminal value:

- Perpetuity Growth Model: This method assumes that cash flows will continue to grow at a stable rate indefinitely. The formula is:

- Exit Multiple Method: This approach uses a multiple (like EBITDA or revenue) applied to the anticipated financial metric at the conclusion of the forecast period to calculate the terminal value.

Step 5: Calculate the Total Present Value

Finally, add the present value of the projected cash flows and the present value of the terminal value to arrive at the total present value of the investment:

Interpreting the Results

Once you have calculated the total present value, you can compare it to the current market value of the investment:

- Undervalued Investment: When the present value is greater than the existing market price, it could mean that the investment is undervalued, signaling a potential opportunity to buy.

- Overvalued Investment: Conversely, if the present value is lower than the current market price, the investment may be overvalued, suggesting it might be wise to avoid or sell.

Limitations of DCF Analysis

While DCF is a powerful valuation tool, it has its limitations:

- Sensitivity to Assumptions: DCF analysis relies heavily on projections and assumptions about future cash flows, growth rates, and discount rates. Small changes in these inputs can significantly impact the valuation.

- Complexity: Building a comprehensive DCF model requires a good understanding of financial modeling and forecasting, which may be challenging for novice investors.

- Market Conditions: DCF does not account for market sentiment or macroeconomic factors that can influence an investment’s value.

- Long-Term Focus: DCF analysis is best suited for long-term investments, making it less applicable for short-term trading strategies.

Conclusion

Discounted Cash Flow (DCF) analysis is an essential tool for investors looking to value investments accurately and make informed decisions. By grasping the methodology and implementing it properly, you can evaluate the intrinsic value of an investment according to its anticipated future cash flows.

While DCF analysis has its limitations, its focus on cash flow and the time value of money makes it a valuable approach in the world of finance. As you gain experience in using DCF, you will become more adept at identifying undervalued opportunities and making sound investment choices. Whether you are a seasoned investor or just starting your journey, mastering the DCF method can significantly enhance your investment strategy and contribute to your financial success.

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Financial Tips!”