JAKARTA, opinca.sch.id – Bonds: Understanding Fixed-Income Investments for Portfolio Stability can sound kinda intimidating at first, right? I used to scroll past bond news and think, “Nah, that’s not for me.” But let me tell you, once I got past the FOMO and gave bonds a shot, my whole take on Financial stability changed for the better.

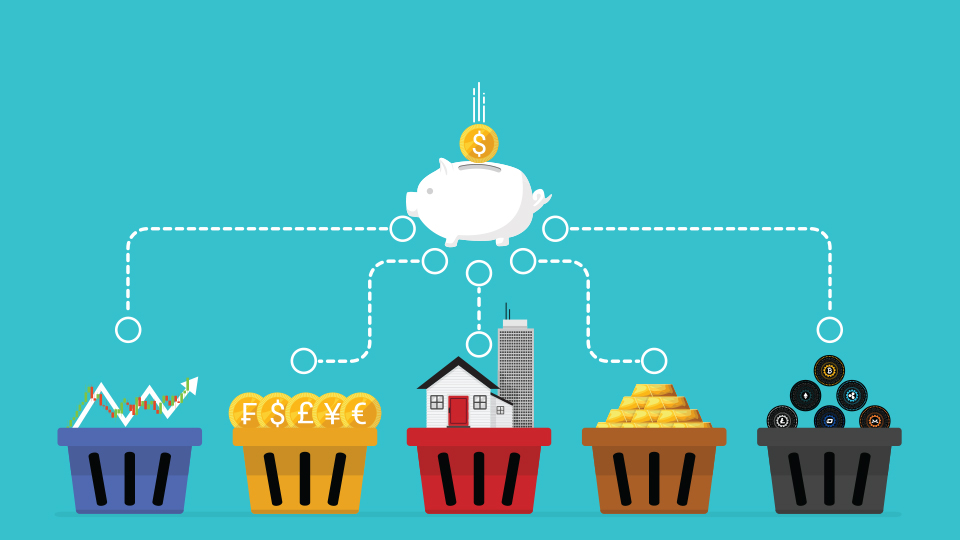

In the world of investing, achieving a balanced portfolio is crucial for managing risk and ensuring long-term growth. Among the various asset classes available, bonds play a vital role in providing stability and income. This guide will delve into the fundamentals of bonds, their importance in a diversified portfolio, and why incorporating fixed-income investments can bring a sense of calm to your investment strategy.

1. What Are Bonds?

Bonds are fixed-income securities that represent a loan made by an investor to a borrower, typically a corporation or government. In exchange for lending money, the bondholder receives periodic interest payments, known as coupon payments, and the return of the bond’s face value upon maturity.

Key Features of Bonds:

- Face Value: The amount the bondholder will receive at maturity, usually $1,000.

- Coupon Rate: The interest rate the bond issuer pays to the bondholder, expressed as a percentage of the face value.

- Maturity Date: The date when the bond will expire, and the issuer will repay the face value to the bondholder.

- Yield: The overall return on the bond, taking into account the coupon payments and any changes in the bond’s price.

2. The Importance of Bonds in a Portfolio

Incorporating bonds into your investment portfolio offers several benefits that enhance overall stability and reduce risk:

– Diversification

Bonds provide diversification, which is essential for mitigating risk. When stock markets are volatile, bonds often perform differently than equities, helping to balance potential losses.

Example: During economic downturns, while stock prices may fall, high-quality bonds tend to maintain their value, providing a cushion for your portfolio.

– Steady Income Stream

Bonds generate regular income through coupon payments, making them an attractive option for investors seeking predictable cash flow. This steady income can be particularly beneficial for retirees or those looking to fund specific financial goals.

Tip: Consider investing in bonds with varying maturities to create a laddered bond portfolio, ensuring a consistent income stream over time.

– Capital Preservation

Bonds, especially those issued by stable governments or well-established corporations, are generally considered lower risk compared to stocks. This characteristic makes them an effective tool for capital preservation.

Real Story: During my investment journey, I allocated a portion of my portfolio to government bonds, which helped protect my capital during market fluctuations.

3. Types of Bonds to Consider

There are several types of bonds available to investors, each with its characteristics and risk profiles:

– Government Bonds

Issued by national governments, these bonds are considered low-risk investments. Examples include U.S. Treasury bonds, which are backed by the full faith and credit of the government.

– Municipal Bonds

These bonds are issued by states, cities, or other local government entities. They often provide tax-exempt interest income, making them attractive for investors in higher tax brackets.

Tip: Research the credit ratings of municipal bonds to assess their risk and potential returns.

– Corporate Bonds

Issued by corporations to raise capital, corporate bonds typically offer higher yields than government bonds but come with increased risk. It’s essential to evaluate the issuer’s creditworthiness before investing.

Example: Investment-grade corporate bonds are issued by financially stable companies, while high-yield (junk) bonds carry a higher risk of default but offer greater potential returns.

4. Strategies for Investing in Bonds

To effectively incorporate bonds into your investment strategy, consider the following approaches:

– Assess Your Risk Tolerance

Before investing in bonds, evaluate your risk tolerance and investment goals. This assessment will help you determine the appropriate types and amounts of bonds to include in your portfolio.

Tip: Younger investors may focus on growth-oriented investments, while those nearing retirement might prioritize capital preservation through bonds.

– Monitor Interest Rates

Interest rates have a significant impact on bond prices. When interest rates rise, bond prices typically fall, and vice versa. Stay informed about economic conditions and central bank policies to make informed decisions.

Real Story: I learned the importance of monitoring interest rates when I held bonds during a period of rising rates, which negatively affected their market value. This experience taught me to be proactive in adjusting my bond holdings.

– Rebalance Your Portfolio

Regularly review and rebalance your portfolio to ensure that your bond allocation aligns with your investment goals and risk tolerance. This practice helps maintain diversification and manage risk effectively.

5. Conclusion

Bonds are a crucial component of a well-rounded investment portfolio, providing stability, income, and diversification. By understanding the fundamentals of bonds and their role in risk management, you can make informed decisions that contribute to your long-term financial success.

Incorporating bonds into your portfolio can bring a sense of calm, especially during turbulent market conditions. By focusing on capital preservation and steady income, you can navigate the complexities of investing with greater confidence.

As you consider your investment strategy, remember that a balanced approach that includes bonds can enhance your portfolio’s resilience and help you achieve your financial goals. Embrace the benefits of fixed-income investments, and enjoy the peace of mind that comes with a well-structured portfolio.

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Stocks: Exploring Equity Investments for Growth and Ownership!”