JAKARTA, opinca.sch.id – Dividend Discount Model: Valuing Equities Through Future Cash Flows. Yeah, that sounds like a mouthful, but trust me—it’s one of those ‘Financial’ things you’ll want to get your head around if you’re into stocks or, well, want to avoid my rookie mistakes.

The Dividend Discount Model (DDM) is a fundamental method used to estimate the intrinsic value of a company’s stock based on the expected future dividends it will pay to shareholders. By discounting these future cash flows back to their present value, investors can make informed decisions about whether a stock is overvalued or undervalued in the market. In this article, I will share my insights and lessons learned while using the Dividend Discount Model, along with practical tips for effectively applying this method in your investment strategy.

Understanding the Dividend Discount Model

What is the Dividend Discount Model?

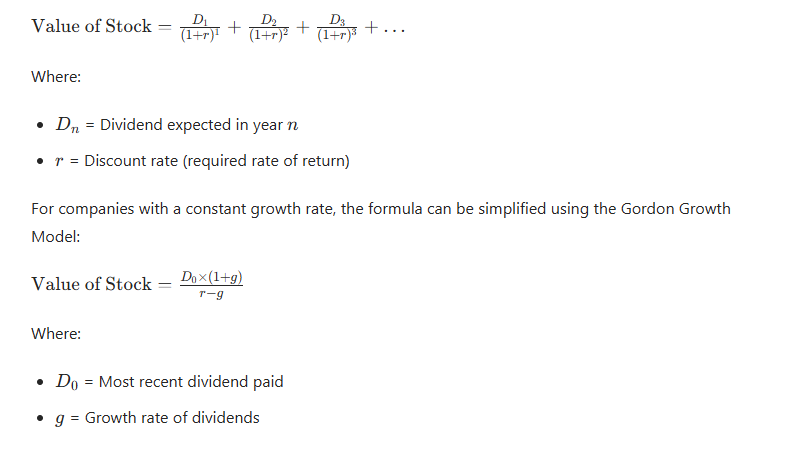

The Dividend Discount Model is built on the premise that the value of a stock is equal to the present value of all future dividends expected to be paid. The basic formula for the DDM is:

My Real Tips and Lessons Learned

1. Understand the Company’s Dividend Policy

Before applying the DDM, it’s crucial to understand the company’s dividend policy and history. Here are some key points to consider:

- Consistency of Dividends: Look for companies with a track record of consistently paying dividends. Stable or increasing dividends indicate a reliable income stream.

- Payout Ratio: Analyze the payout ratio (the percentage of earnings paid as dividends). A sustainable payout ratio generally suggests that the company can continue to pay dividends in the future.

2. Estimate Future Dividends Accurately

Accurate estimation of future dividends is critical for the DDM. Here’s how to approach it:

- Historical Growth Rates: Examine the historical growth rates of the company’s dividends over the past several years. This can provide a baseline for future growth expectations.

- Industry Comparisons: Compare the company’s dividend growth with its peers in the industry. This context can help you gauge whether your growth estimates are realistic.

3. Choose the Right Discount Rate

Selecting an appropriate discount rate is vital for accurate valuation. Consider the following:

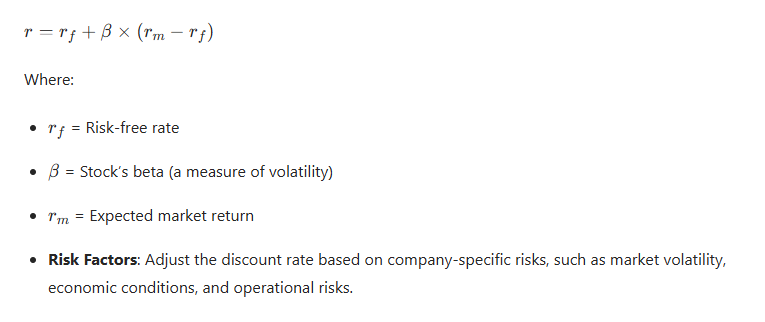

- Cost of Equity: The discount rate should reflect the required rate of return for equity investors. You can estimate this using the Capital Asset Pricing Model (CAPM):

4. Be Cautious with Growth Assumptions

When using the Gordon Growth Model, it’s essential to be realistic about growth assumptions. Here are some tips:

- Long-Term Growth Rate: Use a long-term growth rate that reflects the company’s potential and the overall economic environment. Avoid overly optimistic projections.

- Terminal Value: If you’re estimating dividends far into the future, consider calculating a terminal value to simplify your analysis.

5. Validate Your Results

After calculating the intrinsic value using the DDM, validate your findings through additional methods:

- Comparative Analysis: Compare the DDM valuation with other valuation methods, such as the Price-to-Earnings (P/E) ratio or the Free Cash Flow (FCF) model, to ensure consistency.

- Market Sentiment: Consider the current market sentiment and price of the stock. If your calculated intrinsic value significantly differs from the market price, investigate further to understand why.

Conclusion

The Dividend Discount Model is a powerful tool for valuing equities based on future cash flows. By understanding a company’s dividend policy, accurately estimating future dividends, choosing the right discount rate, being cautious with growth assumptions, and validating your results, you can effectively leverage the DDM in your investment strategy. My experiences with the Dividend Discount Model have taught me the importance of thorough analysis and realistic expectations. As you embark on your journey in equity valuation, remember that diligent research and careful consideration will lead to more informed investment decisions.

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Profitability Index: Maximizing Investment Value and Project Selection!”