JAKARTA, opinca.sch.id – Ever heard of the Profitability Index: Maximizing Investment Value and Project Selection? Honestly, when I first saw those words, I thought it was just another fancy way of crunching numbers. Turns out, it changed the way I decide where to park my money!

The Profitability Index (PI) is a crucial financial metric used in capital budgeting and investment analysis. It measures the relationship between the present value of future cash flows generated by an investment and the initial investment cost. By providing a straightforward way to evaluate the potential profitability of projects, the Profitability Index helps investors and decision-makers select the most valuable investments. This article explores the concept of the Profitability Index, its calculation, advantages, and how it can be used for smarter investing and project selection.

Understanding the Profitability Index

What is the Profitability Index?

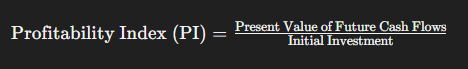

The Profitability Index is defined as the ratio of the present value of future cash flows to the initial investment. It is calculated using the following formula:

A Profitability Index greater than 1 indicates that the investment is expected to generate more value than its cost, while a PI less than 1 suggests that the investment may not be worthwhile.

Importance of the Profitability Index

- Investment Evaluation: The Profitability Index provides a clear indication of an investment’s potential return relative to its cost, making it easier for investors to assess different projects.

- Comparative Analysis: When comparing multiple investment opportunities, the Profitability Index helps prioritize projects based on their expected profitability, allowing for more informed decision-making.

- Resource Allocation: By identifying the most profitable projects, organizations can allocate their resources more effectively, maximizing overall return on investment (ROI).

How to Calculate the Profitability Index

To calculate the Profitability Index, follow these steps:

- Estimate Future Cash Flows: Determ

- ine the expected cash flows generated by the investment over its useful life.

- Determine the Discount Rate: Select an appropriate discount rate based on the risk profile of the investment and the cost of capital.

- Calculate Present Value: Discount the future cash flows to their present value using the formula:

Present Value=∑Cash Flow/(1+r)n

Where r is the discount rate and n is the time period.

- Calculate the Profitability Index: Use the formula provided earlier to calculate the Profitability Index.

Example Calculation

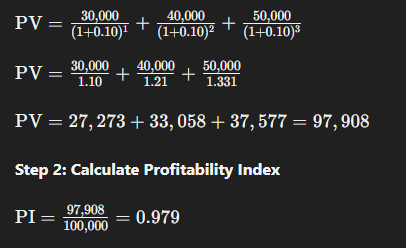

Let’s consider an example to illustrate how to calculate the Profitability Index:

- Initial Investment: $100,000

- Expected Cash Flows:

- Year 1: $30,000

- Year 2: $40,000

- Year 3: $50,000

- Discount Rate: 10%

Step 1: Calculate Present Value of Cash Flows

Step 2: Calculate Profitability Index

In this case, the Profitability Index is 0.979, indicating that the project may not be a worthwhile investment since the PI is less than 1.

Advantages of Using the Profitability Index

- Simplicity: The Profitability Index is easy to calculate and understand, making it accessible for investors and decision-makers.

- Focus on Value Creation: Unlike other metrics, such as Net Present Value (NPV), the Profitability Index emphasizes the value created per dollar invested, providing a clear picture of investment efficiency.

- Effective for Ranking Projects: The Profitability Index is particularly useful for ranking multiple projects when capital is limited, helping organizations focus on the most promising opportunities.

Practical Insights for Smarter Investing

- Use in Conjunction with Other Metrics: While the Profitability Index is a valuable tool, it should be used alongside other financial metrics like NPV, Internal Rate of Return (IRR), and Payback Period for a comprehensive investment analysis.

- Consider Qualitative Factors: In addition to quantitative analysis, consider qualitative factors such as market trends, regulatory changes, and competitive landscape when evaluating investment opportunities.

- Regularly Review Investments: Continuously monitor and reassess investments using the Profitability Index and other metrics to ensure they align with changing market conditions and organizational goals.

- Educate Stakeholders: Ensure that key stakeholders understand the Profitability Index and its implications for investment decisions. This knowledge can facilitate better decision-making and alignment on strategic priorities.

Conclusion

The Profitability Index is a powerful tool for maximizing investment value and guiding project selection. By providing a clear measure of the expected return on investment relative to its cost, the Profitability Index helps investors make informed decisions and prioritize projects effectively. By incorporating the Profitability Index into their investment analysis strategies, investors can enhance their decision-making processes and ultimately achieve smarter investing outcomes.

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Exchange-Traded Funds: Modern Investment Strategies and Portfolio Diversification!”