JAKARTA, opinca.sch.id – Navigating the world of investing requires a solid understanding of market cycles. Among the most critical concepts in this realm are bull and bear markets. These cycles can significantly impact investment strategies and financial decisions. In this article, I will share my real financial lessons learned from experiencing both bull and bear markets, helping you understand their characteristics, implications, and how to adapt your investment approach accordingly.

What Are Market Cycles?

Definition of Market Cycles

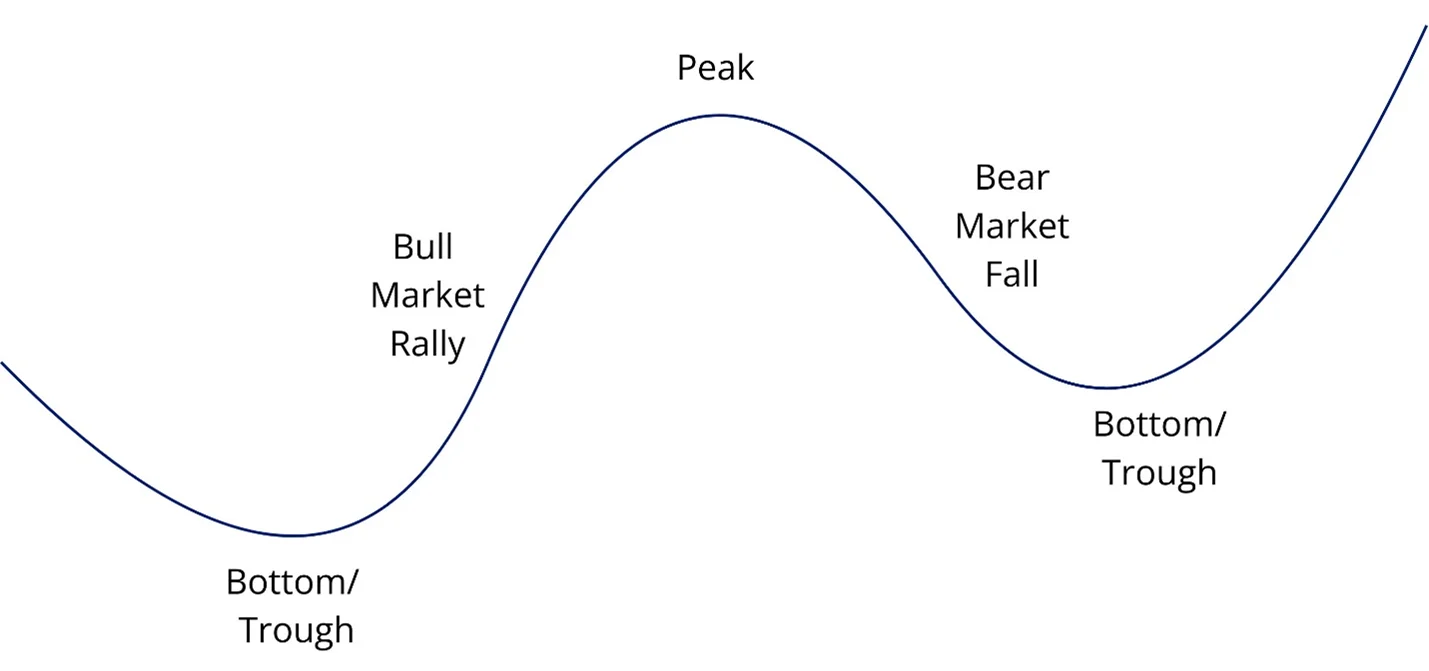

Market cycles denote the natural variations in the financial markets, marked by phases of increasing and decreasing prices. These cycles are influenced by various factors, including economic indicators, investor sentiment, geopolitical events, and changes in monetary policy. Understanding these cycles is essential for investors, as they can inform decisions about when to buy, hold, or sell assets.

Importance of Understanding Market Cycles

Understanding market cycles is crucial for several reasons:

- Investment Timing: Recognizing the phase of the market cycle can help investors make informed decisions about entering or exiting positions.

- Risk Management: Awareness of market conditions allows investors to adjust their portfolios to mitigate risks associated with downturns.

- Long-Term Strategy: Understanding market cycles can guide investors in developing a long-term investment strategy that aligns with their financial goals.

Bull Markets: The Rise of Optimism

Characteristics of Bull Markets

A BM is marked by increasing asset prices, usually defined as a 20% rise in market indexes from their recent lows. Bull markets are often driven by:

- Strong Economic Indicators: Low unemployment rates, increasing GDP, and rising corporate profits contribute to investor confidence.

- Positive Market Sentiment: Investor optimism can lead to increased buying activity, further fueling price increases.

- Low-Interest Rates: Favorable monetary policy can encourage borrowing and investing, driving demand for assets.

My Lessons from Bull Markets

- Stay Invested: During a bull market, it’s tempting to chase high-flying stocks, but maintaining a diversified portfolio can help manage risk while still participating in market gains.

- Take Profits: While it’s essential to stay invested, it’s also crucial to periodically take profits. Selling a portion of your winning investments can help lock in gains and rebalance your portfolio.

- Avoid Complacency: The euphoria of a bull market can lead to overconfidence. It’s important to remain disciplined and stick to your investment strategy rather than getting swept away by market hype.

Bear Markets: The Fall of Caution

Characteristics of Bear Markets

A bear market is defined as a decline of 20% or more in market indexes from recent highs. Bear markets can arise from various factors, including:

- Economic Recession: Declining GDP, rising unemployment, and decreasing consumer spending can trigger bear markets.

- Negative Market Sentiment: Fear and uncertainty can lead to widespread selling, exacerbating price declines.

- Rising Interest Rates: Tightening monetary policy can dampen economic growth and investor confidence, leading to sell-offs.

My Lessons from Bear Markets

- Stay Calm: Fear can drive irrational decisions during a bear market. Maintaining a level head and sticking to your long-term investment plan is crucial.

- Look for Opportunities: Bear markets can present buying opportunities for undervalued assets. Conduct thorough research to identify quality investments that may be temporarily depressed.

- Reassess Your Risk Tolerance: A bear market often reveals the true risk tolerance of investors. Use this time to evaluate your risk appetite and adjust your portfolio accordingly.

Navigating Market Cycles: Strategies for Success

Developing a Long-Term Strategy

- Diversification: A diversified portfolio can help mitigate risk during both bull and bear markets. By spreading investments across various asset classes and sectors, you can reduce the impact of market fluctuations on your overall portfolio.

- Regular Rebalancing: Periodically rebalancing your portfolio ensures that you maintain your desired asset allocation. This practice can help you capitalize on gains during bull markets and protect your investments during bear markets.

- Dollar-Cost Averaging: This strategy involves consistently investing a fixed amount of money over time, regardless of market conditions. Dollar-cost averaging can help reduce the impact of volatility and lower the average cost of your investments.

Staying Informed

- Monitor Economic Indicators: Keeping an eye on key economic indicators, such as GDP growth, unemployment rates, and consumer confidence, can provide valuable insights into the current market cycle.

- Follow Market Trends: Staying informed about market trends and sentiment can help you anticipate potential shifts between bull and bear markets.

- Educate Yourself: Continuously learning about investing and market cycles can empower you to make informed decisions and adapt your strategy as needed.

Conclusion

In conclusion, understanding market cycles—specifically bull and bear markets—is essential for successful investing. My real financial lessons from experiencing these cycles have taught me the importance of staying calm, maintaining a diversified portfolio, and being disciplined in my investment approach.

By recognizing the characteristics of each market phase and adapting your strategy accordingly, you can navigate the complexities of the financial markets more effectively. Whether you’re in a bull market, enjoying the fruits of your investments, or facing a bear market, where caution is key, the knowledge of market cycles will serve as a valuable tool in your investment journey.

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Assessing Financial Performance!”