JAKARTA, opinca.sch.id – Investing in the stock market can be both rewarding and challenging, and understanding how to evaluate a company’s potential for growth is crucial for maximizing your investment returns. One effective way to assess this potential is through Earnings Growth Models. These models help investors predict future earnings growth based on historical performance and various financial metrics. In this article, we will explore different earnings growth models, strategies for implementation, and real-life lessons to enhance your investment approach.

What are Earnings Growth Models?

Earnings Growth Models are analytical tools used to estimate a company’s future earnings based on its past performance, industry trends, and macroeconomic factors. These models take into account various factors that influence a company’s ability to generate profits over time. By understanding these models, investors can make more informed decisions about which stocks to buy, hold, or sell.

Key Components of Earnings Growth Models

- Historical Earnings Data: Analyzing a company’s past earnings growth provides a foundation for projecting future performance. Look for consistent growth patterns and trends over several years.

- Earnings Per Share (EPS): EPS is a critical metric that reflects a company’s profitability on a per-share basis. It helps investors gauge how much profit a company generates for each outstanding share.

- Growth Rates: The growth rate is the percentage increase in earnings over a specific period. Investors often use compound annual growth rate (CAGR) to measure growth over multiple years.

- Market Conditions: Economic factors, industry trends, and competitive dynamics can significantly impact a company’s earnings growth potential. Assessing the broader market environment is essential for accurate modeling.

- Management Guidance and Analyst Estimates: Company management often provides guidance on expected earnings growth, while analysts publish their forecasts. These insights can help refine your growth estimates.

Common Earnings Growth Models

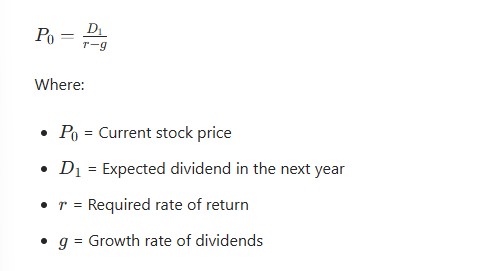

1. Gordon Growth Model (Dividend Discount Model)

The Gordon Growth Model (GGM) is a popular method for valuing a stock based on its expected future dividends. It assumes that dividends will grow at a constant rate indefinitely. The formula is:

Application: This model is particularly useful for mature companies with a history of stable dividend payments. For example, utilities and consumer staples often exhibit predictable dividend growth, making them suitable candidates for GGM analysis.

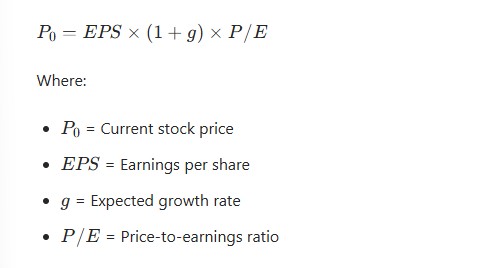

2. Price-to-Earnings (P/E) Ratio Growth Model

The P/E ratio is a widely used valuation metric that compares a company’s current share price to its earnings per share. The P/E ratio growth model estimates future earnings growth based on historical P/E ratios and expected growth rates.

Application: This model is effective for companies in growth industries where earnings are expected to rise significantly. For instance, technology companies often have higher P/E ratios due to their anticipated growth, making this model applicable.

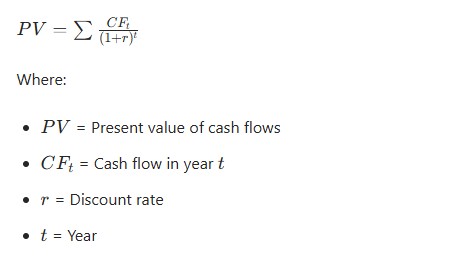

3. Discounted Cash Flow (DCF) Model

While primarily a valuation method, the DCF model can also be adapted to forecast earnings growth. By estimating future cash flows and discounting them back to their present value, investors can determine a company’s intrinsic value based on its earnings potential.

Application: DCF is suitable for companies with fluctuating earnings or those in early growth stages. For example, startups often reinvest profits for growth, making cash flow analysis essential for understanding their long-term potential.

Strategies for Maximizing Investment Returns

1. Diversify Your Portfolio

Utilizing multiple earnings growth models across various sectors can help mitigate risk. Diversification allows you to balance potential losses in one area with gains in another. For instance, combining growth stocks with dividend-paying stocks can create a well-rounded portfolio.

2. Focus on Quality Companies

Invest in companies with strong fundamentals, such as consistent earnings growth, robust cash flow, and a competitive advantage. Quality companies are more likely to weather economic downturns and continue growing over time.

3. Monitor Economic Indicators

Stay informed about economic trends and indicators that can impact earnings growth, such as interest rates, inflation, and consumer spending. Understanding these factors can help you make timely investment decisions.

4. Reassess Regularly

Regularly review your investment portfolio and reassess your earnings growth models. Market conditions change, and a company’s growth potential may shift over time. Adjust your strategies accordingly to ensure alignment with your investment goals.

5. Consider Management Quality

Evaluate the quality of a company’s management team. Strong leadership can significantly impact a company’s ability to execute its growth strategy and navigate challenges. Look for management with a proven track record of delivering results.

Real-Life Lessons from Earnings Growth Models

Lesson 1: The Importance of Patience

Investing based on earnings growth models requires patience. For example, Amazon’s stock was often viewed skeptically due to its low profits in the early years. However, those who understood its long-term growth potential and held onto their investments saw substantial returns as the company expanded its market presence.

Lesson 2: Beware of Overvaluation

During market booms, stocks can become overvalued based on optimistic earnings growth projections. The dot-com bubble in the late 1990s is a prime example where many tech companies were priced based on unrealistic growth expectations. Investors should remain vigilant and use earnings growth models to assess whether a stock’s price aligns with its intrinsic value.

Lesson 3: The Power of Consistency

Companies with a history of consistent earnings growth often outperform those with erratic performance. For instance, consumer goods companies like Procter & Gamble have demonstrated stable earnings growth over decades, making them reliable investments for conservative investors.

Lesson 4: Adaptability is Key

The ability to adapt your investment strategy based on changing market conditions is crucial. For instance, during economic downturns, focusing on companies with strong balance sheets and resilient earnings growth can help safeguard your investments.

Conclusion

Earnings Growth Models are invaluable tools for investors seeking to maximize their investment returns. By understanding and applying various models, such as the Gordon Growth Model, P/E Ratio Growth Model, and DCF Model, investors can make informed decisions about which stocks to pursue.

Incorporating strategies like diversification, focusing on quality companies, and staying attuned to economic indicators can further enhance your investment approach. Moreover, learning from real-life lessons in the market can provide valuable insights into the importance of patience, vigilance, and adaptability.

By leveraging earnings growth models and implementing these strategies, you can position yourself for success in the dynamic world of investing. With diligence and a keen understanding of market dynamics, you can navigate the complexities of investment returns and achieve your financial goals.

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Discounted Cash Flow!”