JAKARTA, opinca.sch.id – Planning for retirement is a crucial aspect of financial management that often gets overlooked until it’s too late. As life expectancy increases and retirement ages rise, understanding how much you need to save for a comfortable retirement is more important than ever. This article will explore practical strategies for planning for retirement, incorporating real-life lessons and straightforward mathematical calculations to help you set realistic savings goals.

Understanding the Importance of Retirement Planning

Retirement planning involves preparing for your financial needs in the later stages of your life. It’s not just about saving money; it’s about ensuring that you can maintain your desired lifestyle when you no longer have a regular paycheck. Here are a few reasons why retirement planning is essential:

- Increased Longevity: With advancements in healthcare, people are living longer. This means your retirement savings need to last longer than ever before.

- Inflation: The cost of living tends to rise over time. Your savings must keep pace with inflation to maintain your purchasing power.

- Healthcare Costs: Medical expenses can be significant in retirement. Planning for these costs is crucial to avoid financial strain.

- Social Security: Many people cannot rely solely on Social Security benefits to fund their retirement. It’s essential to have additional savings to supplement these benefits.

How Much Should You Save for Retirement?

Determining how much you need to save for retirement can be daunting, but breaking it down into manageable steps can simplify the process. Here’s a simple approach to help you get started.

1. Assess Your Retirement Needs

Start by estimating how much money you will need annually during retirement. Consider the following factors:

- Desired Lifestyle: Think about the lifestyle you want to maintain. Will you travel frequently, or do you plan to downsize your living situation?

- Current Expenses: Review your current expenses to estimate what you might need in retirement. This includes housing, food, healthcare, transportation, and leisure activities.

- Inflation Rate: Factor in an average inflation rate of 2-3% per year to ensure your savings can keep up with rising costs.

2. Use the 80% Rule

A common guideline is the 80% rule, which indicates that you will require approximately 80% of your income before retirement to sustain your standard of living during retirement. For example, if you currently earn $100,000 per year, you might aim for an annual retirement income of $80,000.

3. Calculate Your Retirement Savings Goal

After estimating your annual retirement requirements, you can determine your overall retirement savings target by applying the 25 x rule. This guideline indicates that you should strive to save 25 times the annual retirement income you wish to receive.

Example Calculation:

- Desired Annual Income: $80,000

- Retirement Savings Goal: 80,000×25=2,000,000

In this example, you would aim to save $2 million by the time you retire.

4. Determine How Much to Save Each Month

Now that you have a retirement savings goal, you can determine how much you need to save each month to reach that goal. This calculation will depend on several factors, including your current age, the age at which you plan to retire, and the expected rate of return on your investments.

Using a Retirement Calculator

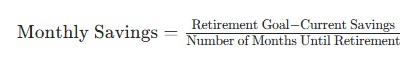

You can use a retirement calculator to simplify this process, but here’s a basic formula to calculate your monthly savings:

Example Calculation:

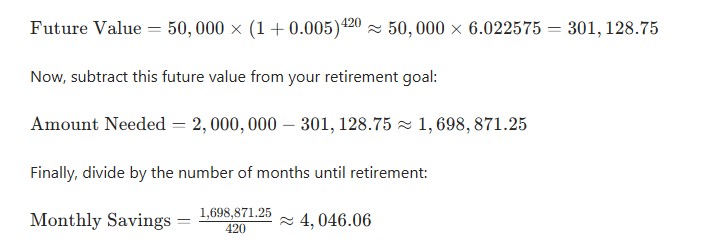

Assuming you are 30 years old, plan to retire at 65, and have $50,000 saved:

- Retirement Goal: $2,000,000

- Current Savings: $50,000

- Years Until Retirement: 35 years (or 420 months)

- Expected Annual Return: 6% (0.5% monthly)

First, calculate the future value of your current savings:

![]()

Where:

To reach your retirement goal, you would need to save approximately $4,046 per month.

5. Adjust for Inflation and Investment Returns

As you plan for retirement, it’s essential to adjust your calculations for inflation and potential investment returns. A conservative estimate for annual returns on investments is around 6-8%, depending on your asset allocation and market conditions.

6. Regularly Review and Adjust Your Plan

Retirement planning is not a one-time event. Life circumstances change, and so do financial markets. Here are some tips for maintaining your retirement plan:

- Annual Reviews: Review your retirement savings and investment performance annually to ensure you’re on track.

- Adjust Contributions: If you receive a raise or bonus, consider increasing your retirement contributions.

- Reassess Goals: If your lifestyle or financial situation changes, reassess your retirement goals and adjust your savings plan accordingly.

Real-Life Lessons in Retirement Planning

- Start Early: The earlier you start saving for retirement, the more time your money has to grow through compound interest. Even small contributions can add up significantly over time.

- Stay Disciplined: Consistency is key. Automate your savings to ensure you contribute regularly without having to think about it.

- Diversify Investments: Diversifying your investment portfolio can help manage risk and improve returns.

- Educate Yourself: Financial literacy is crucial. Take the time to learn about different investment options, retirement accounts, and strategies.

- Seek Professional Guidance: If retirement planning seems daunting, think about seeking advice from a financial advisor. They can provide personalized advice and help you create a tailored retirement plan.

Conclusion

Planning for retirement is a vital aspect of financial health that requires careful consideration and proactive management. By understanding how much you need to save, using simple math and real-life lessons, you can set realistic goals and work toward a secure financial future. Start today, stay disciplined, and regularly review your plan to ensure you’re on track for the retirement you envision. Remember, the earlier you begin planning for retirement, the more comfortable and secure your future will be.

Boost Your Competence: Uncover Our Insights on Financial

Spotlight Article: “Debt Reduction!”